UPU: Challenges and opportunities for postal operators to once again increase volumes – EU Postal MArket, new fees, the EU VAT Ecommerce package

The decline in volumes started in 2019, with a new terminal dues regime adjusting the #UPU #tariffs for letters containing goods. Then the 2021 #EU #VAT #Ecommerce #Package led to postal operators collecting inconsistent and complex #customs charges. In just 2 months (1.1.2022) comes the addition of mandatory charges for the return of undeliverable items. This has all helped contribute to the 40%+ decline in cross-border postal volumes since 2019.

The UPU #postalchannel remains the most important shipping option in cross-border #ecommerce: uniquely standardized, it uses a common #ITinfrastructure to facilitate simple and harmonized exchange.

However, in the EU volumes are shifting away from the postal channel towards commercial solutions offered by designated #postaloperators (DO) (i.e., direct entry solutions for #marketplaces and #onlineretailers who clear customs themselves) and increasingly also towards commercial #CEP solutions.

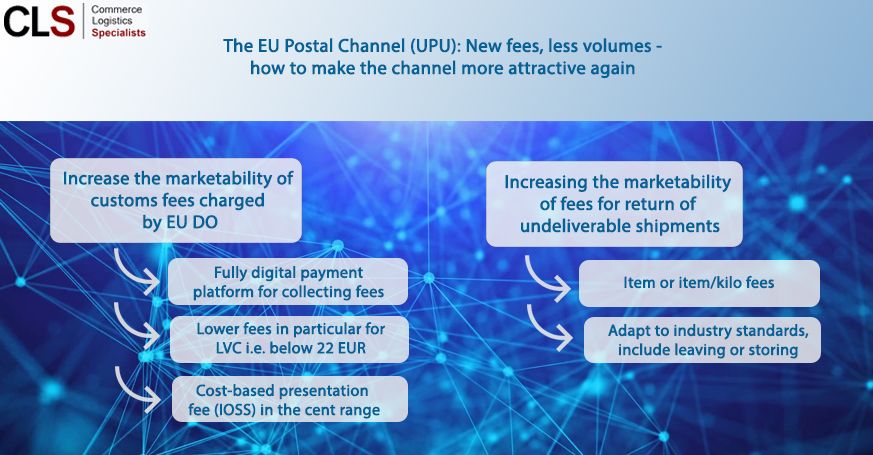

What options would make the UPU channel more attractive for senders?

𝗜𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴 𝘁𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗼𝗳 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗱𝘂𝘁𝗶𝗲𝘀

-𝗖𝗼𝗹𝗹𝗲𝗰𝘁𝗶𝗼𝗻 𝗼𝗳 𝗖𝘂𝘀𝘁𝗼𝗺𝘀 𝗳𝗲𝗲𝘀 are reasonable and necessary. However, in the 21st century, it should be possible to fully digitalize and automate the collection of #customsduties, instead of using post offices or mailmen at the door step. A payment infrastructure / platform using the #paymentchannels already common in ecommerce could be established and operated using an infrastructure accessible to all on a cost basis.

-𝗖𝘂𝘀𝘁𝗼𝗺𝘀 𝗳𝗲𝗲𝘀 on dutiable parcels were originally calculated for medium or high-value parcels, while the bulk of postal volumes fell below the threshold value of EUR 22. Consideration should be given to introducing lower #fees, specifically for Low Value Consignments (#LVC) below this former threshold.

-𝗖𝘂𝘀𝘁𝗼𝗺𝘀 𝗽𝗿𝗲𝘀𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻 𝗳𝗲𝗲𝘀 for IOSS shipments (non-dutiable parcels) now charged by some EU postal services are prohibitively high. A general fee “in the cent range” for digital presentation (if the #data is correct) could be considered, plus a cost-oriented processing fee (if corrections are necessary).

𝗜𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴 𝘁𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗼𝗳 𝗳𝗲𝗲𝘀 𝗳𝗼𝗿 𝗿𝗲𝘁𝘂𝗿𝗻 𝗼𝗳 𝘂𝗻𝗱𝗲𝗹𝗶𝘃𝗲𝗿𝗮𝗯𝗹𝗲 𝘀𝗵𝗶𝗽𝗺𝗲𝗻𝘁𝘀

-These fees make sense in principle. However, to increase marketability, they should (as is current industry standard) be calculated on a per item or item/kilo basis.

– The additional option of leaving or storing return shipments in the EU, a common practice in cross-border ecommerce, should also be considered.

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH