UPU: The new EU postal customs fee structure at a glance

The charges collected by #EU designated operators (DO) for presentation-to-customs and #customsclearance for parcels subject to #importcustoms are changing cross-border #ecommerce logistics

𝗘𝗨 𝗗𝗢𝘀 𝗮𝗽𝗽𝗹𝘆𝗶𝗻𝗴 𝗻𝗲𝘄 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗰𝗹𝗲𝗮𝗿𝗮𝗻𝗰𝗲 𝗳𝗲𝗲𝘀 𝗳𝗼𝗿 𝗶𝗺𝗽𝗼𝗿𝘁𝗶𝗻𝗴 𝗱𝘂𝘁𝗶𝗮𝗯𝗹𝗲 𝗽𝗼𝘀𝘁𝗮𝗹 𝗰𝗼𝗻𝘀𝗶𝗴𝗻𝗺𝗲𝗻𝘁𝘀 𝗶𝗻𝘁𝗼 𝘁𝗵𝗲 𝗘𝗨

Following implementation of the EU #VATEcommercepackage on 1 July 2021, import duties are now charged for every consignment, whatever their value. #Customsfees now also apply on consignments valued at more than EUR 150.

Now, every consignment is dutiable unless the #IOSS scheme is applied. Consequently, all postal consignments sent to the EU using third-country #postaloperators for #transportation – especially those sent C2C or by small and medium-sized #suppliers that do not use an IOSS scheme – are subject to #customsduties.

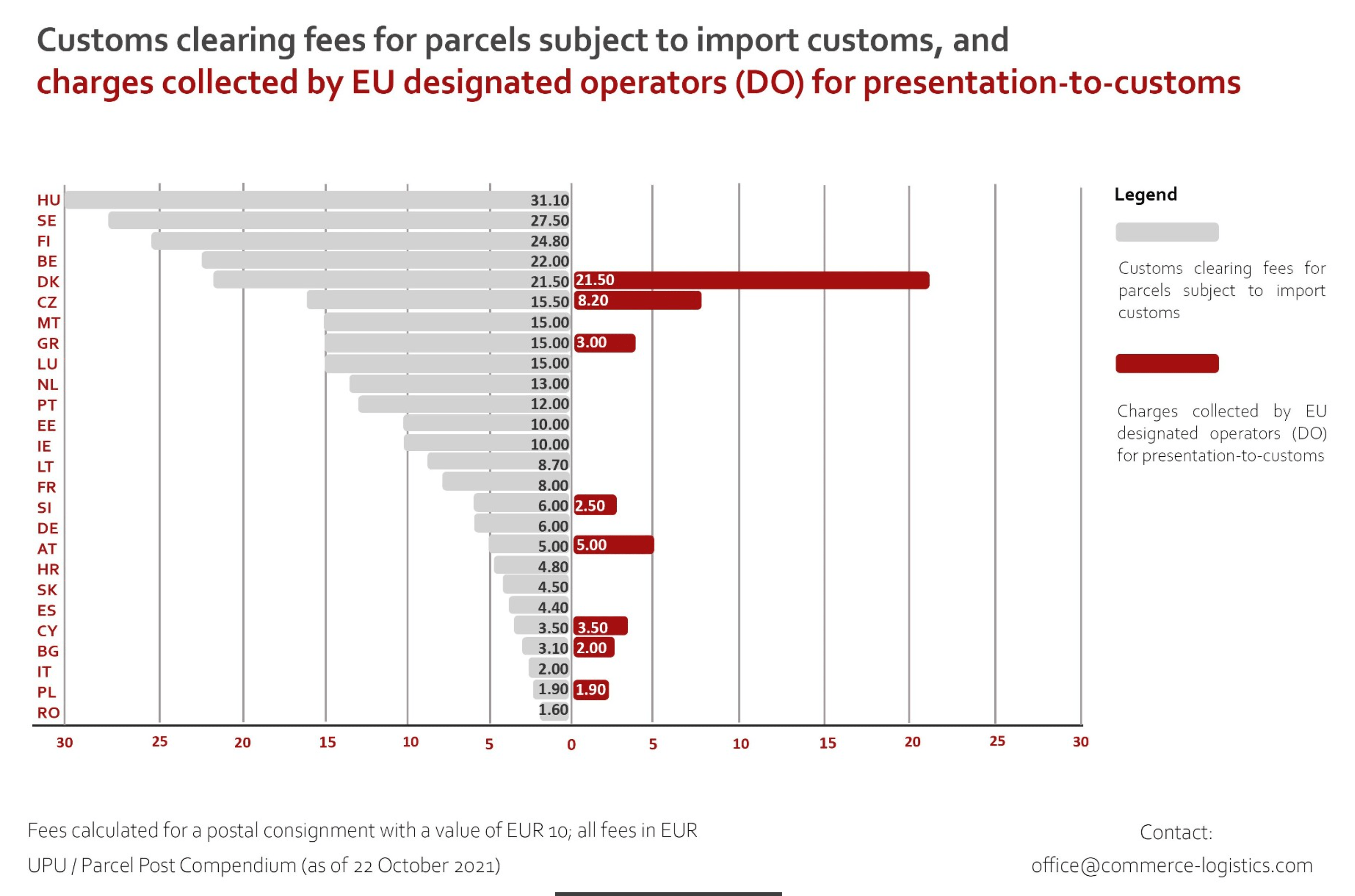

𝗜𝗻 𝘁𝗵𝗲 𝗘𝗨 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗰𝗹𝗲𝗮𝗿𝗮𝗻𝗰𝗲 𝗳𝗲𝗲𝘀 𝗳𝗼𝗿 𝗮 𝗘𝗨𝗥 𝟭𝟬 𝗰𝗼𝗻𝘀𝗶𝗴𝗻𝗺𝗲𝗻𝘁 𝗰𝘂𝗿𝗿𝗲𝗻𝘁𝗹𝘆 𝗿𝗮𝗻𝗴𝗲 𝗯𝗲𝘁𝘄𝗲𝗲𝗻 𝗘𝗨𝗥 𝟭.𝟲𝟬 𝗮𝗻𝗱 𝗘𝗨𝗥 𝟯𝟭.𝟭𝟬

There is no homogeneity in the EU DO charges – neither in the amounts nor for the services provided. There are even differences when it comes to the range within which import duties, but not customs, apply for Low Value Consignments (LVC), e.g., EUR 0-22, 22-50, 50-100 and 100-150. Some EU MS differentiate between direct and indirect representation, or between #C2C and #B2C consignments.

𝗜𝗻 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻, 𝘀𝗲𝘃𝗲𝗿𝗮𝗹 𝗗𝗢 𝗮𝗹𝘀𝗼 𝗰𝗼𝗹𝗹𝗲𝗰𝘁 𝗽𝗿𝗲𝘀𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻-𝘁𝗼-𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗰𝗵𝗮𝗿𝗴𝗲𝘀 𝗳𝗼𝗿 𝗟𝗩𝗖𝘀 𝗱𝗲𝗰𝗹𝗮𝗿𝗲𝗱 𝗮𝘁 𝗰𝘂𝘀𝘁𝗼𝗺𝘀, 𝗲𝘃𝗲𝗻 𝘄𝗵𝗲𝗻 𝘁𝗵𝗲 𝗜𝗢𝗦𝗦 𝘀𝗰𝗵𝗲𝗺𝗲 𝗶𝘀 𝘂𝘀𝗲𝗱, 𝗮𝗻𝗱 𝗻𝗼 𝗱𝘂𝘁𝗶𝗲𝘀 𝗮𝗽𝗽𝗹𝘆. 𝗧𝗵𝗲𝘀𝗲 𝗰𝗵𝗮𝗿𝗴𝗲𝘀 𝗰𝘂𝗿𝗿𝗲𝗻𝘁𝗹𝘆 𝗿𝗮𝗻𝗴𝗲 𝗯𝗲𝘁𝘄𝗲𝗲𝗻 𝗘𝗨𝗥 𝟮 𝗮𝗻𝗱 𝗘𝗨𝗥 𝟮𝟭.𝟱𝟬.

In summary, understanding the new EU #customsclearancefee model for shippers wishing to ship to multiple EU destinations using the #postalchannel has become a science. Commercially, postal customs clearance fees are comparatively high for many destinations. This is particularly the case for LVCs, where charging an average of EUR 11.20 to collect around EUR 2 of #importduties on a consignment valued at EUR 10 actively reduces the #competitiveness of the postal channel.

𝗧𝗵𝗲 𝗰𝗵𝗮𝗿𝘁 𝗯𝗲𝗹𝗼𝘄 𝘀𝗵𝗼𝘄𝘀 𝘄𝗵𝗶𝗰𝗵 𝗰𝗵𝗮𝗿𝗴𝗲𝘀 𝗘𝗨 𝗗𝗢 𝗰𝘂𝗿𝗿𝗲𝗻𝘁𝗹𝘆 𝗰𝗼𝗹𝗹𝗲𝗰𝘁 𝗳𝗼𝗿 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗰𝗹𝗲𝗮𝗿𝗮𝗻𝗰𝗲 𝗮𝗻𝗱 𝗳𝗼𝗿 𝗽𝗿𝗲𝘀𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻-𝘁𝗼-𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝘄𝗵𝗲𝗻 𝗽𝗼𝘀𝘁𝗮𝗹 𝗰𝗼𝗻𝘀𝗶𝗴𝗻𝗺𝗲𝗻𝘁𝘀 𝗮𝗿𝗲 𝘀𝗲𝗻𝘁 𝘁𝗼 𝘁𝗵𝗲 𝗘𝗨 𝘂𝘀𝗶𝗻𝗴 𝘁𝗵𝗲 𝗽𝗼𝘀𝘁𝗮𝗹 (𝗨𝗣𝗨) 𝗰𝗵𝗮𝗻𝗻𝗲𝗹

Source: the UPU Parcel Post Compendium (#PPC) (22.10) which publishes the respective, legally required information on DO clearance fees for parcels subject to import duties and customs fees.

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH