The Future of (E)Commerce / Part 1: A deeper look at cross-border and food commerce

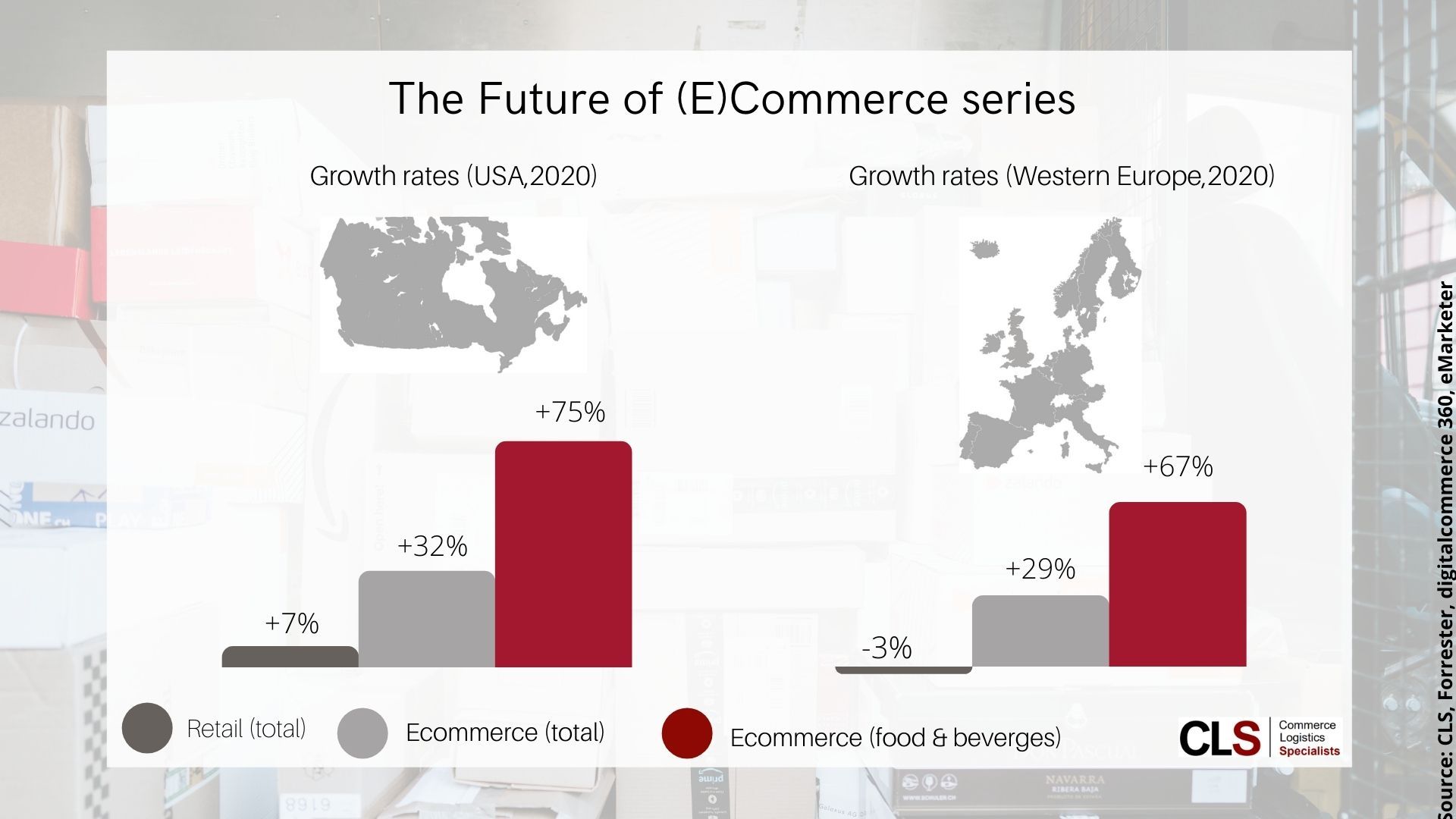

The pandemic has boosted #ecommerce. But all ecommerce?

The pandemic has further fueled the growth of ecommerce following closures or restrictions in stationary #retail. However, one relevant segment of ecommerce has not been able to #profit from this growth – cross-border ecommerce.

Before the pandemic, 𝗰𝗿𝗼𝘀𝘀-𝗯𝗼𝗿𝗱𝗲𝗿 𝗲𝗰𝗼𝗺𝗺𝗲𝗿𝗰𝗲 was the fastest growing market segment by far, with growth rates twice as high as those for domestic ecommerce. Although borders within #Europe largely remained open to #parcel services during the #pandemic, the #challenge lay in the suspension of air traffic.

The sharp #decline in cross-border ecommerce was caused by the #postalservices: unlike #commercial and express #operators, the posts were hit by cancelations of the passenger flights normally used for #postalshipments. The Universal Postal Union (#UPU) statistics speak a clear language – cross-border traffic between designated postal operators is still 1/3rd down on 2019.

In the #EU, this development has been exacerbated by new regulations: while the Import-One-Stop-Shop (IOSS) model appears to offer relief for #marketplaces and commercial parcel services, customers of designated postal operators are affected by a variety of partly untransparent, country-specific and often prohibitively high #additionalfees, which are negatively impacting business.

𝗞𝗲𝘆 𝘁𝗿𝗲𝗻𝗱: The rise of 𝗳𝗼𝗼𝗱 𝗲𝗰𝗼𝗺𝗺𝗲𝗿𝗰𝗲, its hidden impact on ecommerce, #logistics models, and stationary retail.

Another development, stimulated by restaurant closures, has been the massive expansion in online food selling, delivering food to consumers, and the expansion of the associated logistics infrastructure for fast delivery, mainly in urban areas.

In parallel to this, online grocery shopping has also continued to grow. In the USA, food & beverage ecommerce increased by 2/3rds from 2019 to 2021 (from 13 to 21 billion USD).

Food ecommerce is expected to remain the fastest-growing ecommerce market segment, although the overall share of food ecommerce in retail will be comparatively low (5% in the USA, 2021), even less than 2% in Europe.

New #challenge for #marketplace business and logistics models?

Experts have identified potentially fundamental #changes to the basic ecommerce business model, triggered by the exponential growth in meal delivery and food ecommerce. Analysis indicates that the previously successful business and logistics models employed by the market dominant marketplaces – previously believed to be unstoppable – are facing their greatest challenge yet.

We will look more carefully at these groundbreaking developments in Part 2 of this series.

#development #business #growth #food #restaurant #share #statistics #update #CLS

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH