Looking back at the introduction of the IOSS: an overview and impact on E-Commerce

Prior to 1 July 2021, almost all postal shipments were valued at below EUR 22. No #customs or #importduties were due on entering the #EU. On 1 July 2021, the EU VAT Ecommerce package came into force, with import duties now charged for each and every consignment, whatever its value. The new #IOSS scheme has simplified #customs clearance.

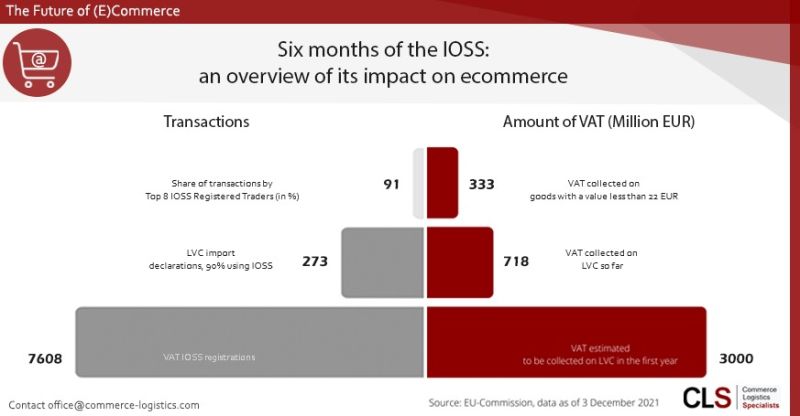

Now that the new model has been in force for more than 5 months, it is time to offer a first overview:

1. As well as creating a level playing field, one of the main objectives of the IOSS – and the reason it faced considerable resistance from some #stakeholders – was the desire of EU Member States to stop suspected #taxevasion through abusive under-declaration and to increase VAT revenues. This goal appears to have been achieved in principle: the EU #Commission estimates that after just one year, around EUR 2 billion in #import VAT will have been collected for low value consignments (#LVC).

2. The introduction of the EU VAT Ecommerce package has further exacerbated the volume decline in cross-border ecommerce that had already begun due to the #pandemic. Although no figures are completely reliable, the cross-border #postalchannel (#UPU) appears to have lost almost 40% in #volume, with imports from China dropping by 20-30%.

3. There are several reasons for this decline, chief among them the lack of IOSS know-how amongst non-EU suppliers, and the high #customsfees being charged, especially by some EU #postaloperators (DO), for dutiable #parcels and for #customsclearance (partly also applicable to IOSS). While the postal channel remains the most important #delivery route to the EU, these fees are creating #uncertainty among #consumers, and a disproportionate increase in the cost of orders for LVC, especially in the C2C and SME segments.

4. Our figures show that, despite the decline in volumes, a large proportion of imports into the EU are still handled using the classic B2B2C model.

5. The EU Commission has already identified several issues such as #doubletaxation, the misuse of IOSS IDs, and #operationalchallenges in the individual Member States. Their proposed response appears to be a move towards a single VAT registration, further extending the #OSS, making IOSS mandatory for import to EU, and even abolishing the 150 EUR threshold.

join in the discussion?

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH