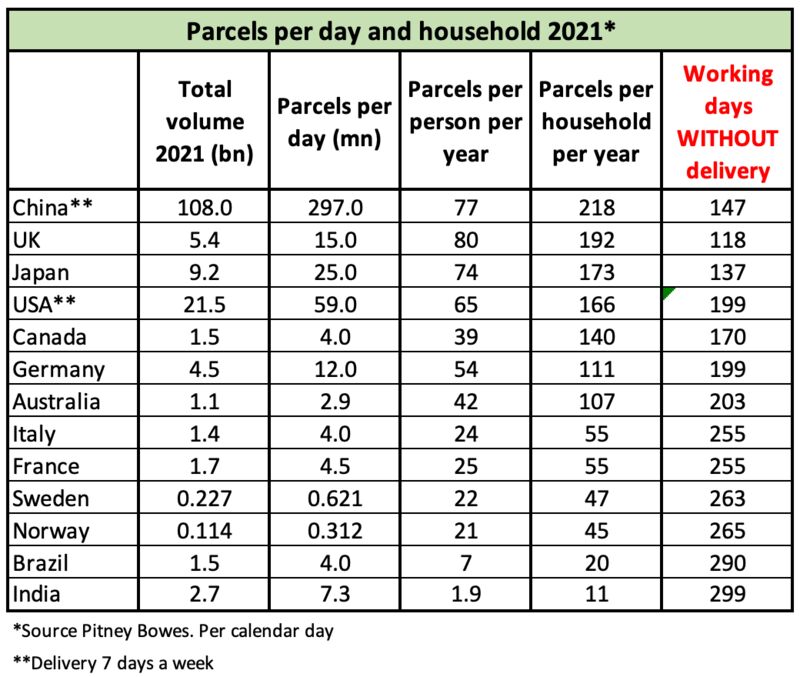

How far away are selected countries from “one delivery per day and household”?

Based on numbers from Pitney Bowes yearly report* on deliveries, it can be calculated how far away from the future with one delivery per day and household these markets are.

This is also a good factor for carriers when deciding on strategy over the years to come i.e., which delivery solutions they must support and / or develop.

The most mature market is the UK with 3.7 deliveries per week and household but also Japan is over 3 deliveries per week/household.

Sweden and Norway with their big Out of Home share, are not even at one (1) delivery per week/household, and without having data on the big locker countries like Poland and the Baltics, I would estimate them being at max. one delivery per week/household.

MAJOR SCALING PROBLEM

This raises the question of whether these countries will be able to scale the OOH capacity to one delivery per day/household or if they will have to rethink their current strategies.

First studies on OOH location density and capacity per location, indicates a major scaling problem. The amount of locations / capacity of the locations is limited and the carriers betting on OOH could end up with a strategy leading into a dead end.

CHANGE OF STRATEGY

Posten Norge AS Norge and PostNord, although still at very low volumes, have changed their strategy towards more home delivery, a change other carriers would be wise to follow.

With the switch to more home delivery and to be able to overcome the problem of missed first time deliveries, one would expect more willingness to cooperate with suppliers of residential solutions for unattended delivery, but this is still not the case.

The reason for this could lie in the break in volume growth the war in Ukraine has caused. Growth is slowing down thereby lowering the pressure on the carriers.

The online retailers also seem to be indifferent to this problem and happily accept shipping price increases of 3 to 10% every year. Normally one would expect lower prices the higher the volume, but not in B2C delivery. This could be laid out as low scalability of the current last mile solutions.

*Pitney Bowes numbers includes both B2B and B2C deliveries, at least in some countries, and are therefore not 100% correct for the calculations above.

More on LinkedIn

Jesper Okkels

Founder