Explained simply by CLS: Postal customs clearance in the EU (Part 3)

𝗗𝗗𝗨 𝗽𝗼𝘀𝘁𝗮𝗹 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗰𝗹𝗲𝗮𝗿𝗮𝗻𝗰𝗲 𝗮𝗳𝘁𝗲𝗿 𝟭 𝗝𝘂𝗹𝘆 𝟮𝟬𝟮𝟭

Since 1.7.2021, #VAT must be paid on all #postal items imported into #EU. A simplified #customs procedure applies for items below an intrinsic value of EUR 150.

– According to EU #regulations, in the case of #DDU (Delivery Duties Unpaid – buyer pays #customsclearance and #fees), the customs fees must be paid by the #buyer.

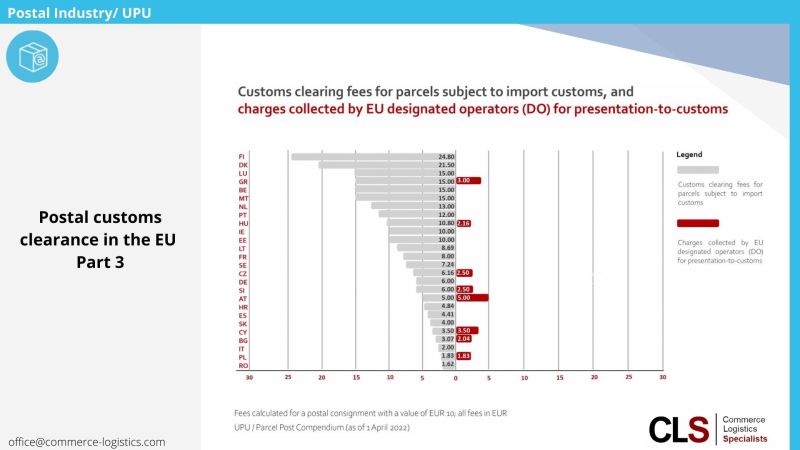

– However, as dealing directly with #customs authorities is time consuming and difficult for #consumers/buyers, this step is managed by #representatives. For postal items, the representative is the designated postal operator (#DO) at #destination, who has the #advantage not needing a separate #power of attorney. The DO is permitted to charge processing #fees for #customs declarations and #collecting the fees from the buyer.

– The processing fees for collecting customs #duties are traditionally fairly high. Prior to 1.7.2021, however, this was irrelevant as almost all postal items fell below the previous threshold #value of EUR 22: no customs fees were due and, using the previous paper-based #model, postal #customsclearance was thus offered free of #charge.

– As of 1.7.2021, postal fees are now collected for all DDU items. As most items are still low-value consignments (<150 EUR), the fees were suddenly very high compared to the #purchase price of the goods.

– The angered recipients, many of whom started refusing to accept #delivery due to the increase in #indirect costs, and to order less #online. DDU #volumes in the postal #channel dropped drastically.

𝗛𝗼𝘄 𝗱𝗶𝗱 𝗘𝗨 𝗗𝗢𝘀 𝗿𝗲𝗮𝗰𝘁?

Although this #development rendered the #UPU postal channel less #competitive, EU DOs did not #lower the processing fees or introduce cheaper (#digital) #paymentoptions. Why?

– Probably because, even with #overall #decreasing #volumes, these fees are still highly #profitable.

– Most items are still delivered by the EU #DOs, collected however directly from #foreign #onlineshops and #marketplaces at origin, bypassing DOs at #origin using the #commercial and not the postal channel.

Apart from recipients, the “losers” here are non-EU DOs: the #major EU DOs used the #fees to circumvent the non-EU DO at origin by channeling non-domestic #volumes directly into their #networks and the networks of their commercial #subsidiaries (DHL, DPD, GLS…), while smaller EU DOs at least earned additional #income from processing fees.

(𝘛𝘰 𝘣𝘦 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦𝘥)

Hier geht es zum LinkedIn-Artikel.

Walter Trezek

Document Exchange Network GmbH