Summary: High-level VAT Roundtable on OSS/IOSS experience

Nearly 3 months after the #EUVATEcommercepackage implementation, more than 65 participants attending the roundtable hosted by Ecommerce Europe were positively impressed. Most low value consignments are imported into the #EU under the #IOSS scheme, and 6,400 IOSS VAT ID numbers have been issued by the EU MS.

𝗚𝗲𝗻𝗲𝗿𝗮𝗹𝗹𝘆 𝘀𝗺𝗼𝗼𝘁𝗵 𝘁𝗿𝗮𝗻𝘀𝗶𝘁𝗶𝗼𝗻 𝗯𝘂𝘁 𝗿𝗼𝗼𝗺 𝗳𝗼𝗿 𝗶𝗺𝗽𝗿𝗼𝘃𝗲𝗺𝗲𝗻𝘁

Given the extent of the #VAT package, there is some room for improvement when it comes to consistency in applying the rules in all the EU-MS, harmonisation of applied code lists and authentic interpretation of the Union Customs Codex.

Leading electronic interfaces may have faced significant challenges in implementing the EU VAT package, but the generally smooth transition can be regarded as a success.

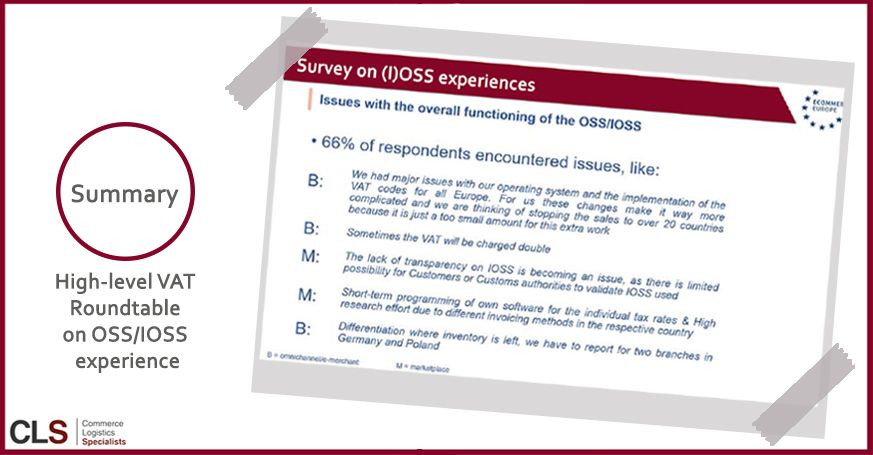

𝗗𝗲𝗹𝗮𝘆𝘀 𝗮𝗻𝗱 𝗱𝗼𝘂𝗯𝗹𝗲 𝘁𝗮𝘅𝗮𝘁𝗶𝗼𝗻 𝗺𝗮𝗶𝗻𝗹𝘆 𝗶𝗻 𝘁𝗵𝗲 𝗽𝗼𝘀𝘁𝗮𝗹 𝗰𝗵𝗮𝗻𝗻𝗲𝗹. 𝗥𝗲𝗮𝗱𝗶𝗻𝗲𝘀𝘀 𝗼𝗳 𝗘𝗨-𝗠𝗦 𝗩𝗔𝗧 𝗮𝗻𝗱 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗮𝘂𝘁𝗵𝗼𝗿𝗶𝘁𝗶𝗲𝘀 𝘃𝗮𝗿𝗶𝗲𝘀

In case of VAT and Customs, the optics are diverse. Some EU-MS authorities lack a degree of readiness; the CZ Republic only passed the VAT package into national legislation a week ago.

Some of the issues highlighted were:

· Significant delays in clearance of imported consignments

· Collection of VAT, even when VAT had been collected under the IOSS scheme at the Point of Sale, resulting in double taxation

Both issues are related to digitally pre-lodged H7 customs declarations. During data transfer, IOSS IDs converted from postal declarations (UPU Model) into the European Customs Data Model were lost. Action to clarify the necessary #data elements used at #UPU level by operators at origin is needed.

Further #harmonisation of product code lists for customs purposes (prohibited and excise goods) is also needed.

𝗢𝗦𝗦 𝘀𝗵𝗼𝘂𝗹𝗱 𝗯𝗲 𝘀𝗶𝗺𝗽𝗹𝗶𝗳𝗶𝗲𝗱 𝘁𝗼 𝗺𝗮𝗻𝗮𝗴𝗲 𝘁𝗵𝗲 𝗺𝘂𝗹𝘁𝗶-𝗰𝗼𝘂𝗻𝘁𝗿𝘆-𝗶𝗻𝘃𝗲𝗻𝘁𝗼𝗿𝘆 𝗰𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲

When inventory is managed in various EU-MS for intra-EU sales, the #OSS scheme fails to simplify and cannot be used. It would be advisable, in future, to extend the OSS scheme to enable a single VAT registration.

𝗦𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝗼𝗳 𝗜𝗢𝗦𝗦 𝗩𝗔𝗧 𝗜𝗗 𝗡𝘂𝗺𝗯𝗲𝗿 𝘂𝘀𝗲 𝗺𝘂𝘀𝘁 𝗯𝗲 𝘀𝘁𝗿𝗲𝗻𝗴𝘁𝗵𝗲𝗻𝗲𝗱

Strengthening the security of IOSS #ID usage remains an issue. Greater transparency, and even linking the IOSS VAT ID number to unique transport IDs or party identifiers would be an option.

𝗣𝗿𝗲𝘀𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻 𝘁𝗼 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗳𝗲𝗲𝘀 𝗻𝗲𝗲𝗱𝘀 𝗺𝗼𝗻𝗶𝘁𝗼𝗿𝗶𝗻𝗴

Finally, the current #development which sees #deliveryoperators charging presentation to customs fees, even for consignments exempt from #taxes or customs fess, requires timely monitoring, even intervention and harmonisation.

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH