Explained simply by CLS: The Evolution of Postal Tariffs (part 3)

𝗘𝘅𝗽𝗹𝗮𝗶𝗻𝗲𝗱 𝘀𝗶𝗺𝗽𝗹𝘆 𝗯𝘆 𝗖𝗟𝗦: 𝗧𝗵𝗲 𝗘𝘃𝗼𝗹𝘂𝘁𝗶𝗼𝗻 𝗼𝗳 𝗣𝗼𝘀𝘁𝗮𝗹 𝗧𝗮𝗿𝗶𝗳𝗳𝘀 (𝗽𝗮𝗿𝘁 𝟯)

Over the past decade, the unprecedented #growth of #ecommerce and #commercial letter post items containing goods distorted the established #UPU model. Lightweight cross-border #letters sent at UPU #rates were considerably cheaper than the corresponding #domesticrates. In addition, the world’s largest and most developed ecommerce #exportmarket, China, was able to use #tariff #discounts enjoyed due to its historical status as a #developing country. Finally, huge volumes of small #packets were being rerouted via #developingcountries that paid lower outbound rates.

𝗜𝗻 𝟮𝟬𝟭𝟵 𝘁𝗵𝗲 𝗨𝗣𝗨 𝗮𝗱𝗮𝗽𝘁𝗲𝗱 𝘁𝗵𝗲 𝗿𝗮𝘁𝗲 𝘀𝘆𝘀𝘁𝗲𝗺, 𝗲𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹𝗹𝘆 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴 𝘁𝗮𝗿𝗶𝗳𝗳𝘀

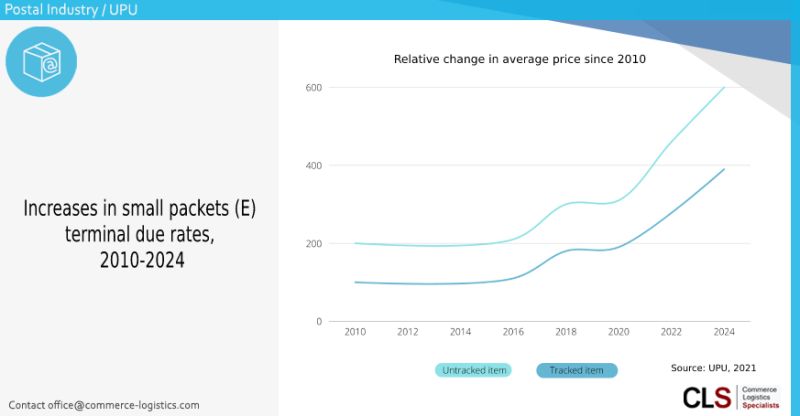

Starting 2016, UPU terminal due rates were gradually increased to correct this imbalance. Finally, largely due to #pressure from the USA, the system was fundamentally adjusted in 2019.

-Designated operators (#DO) were allowed to charge self-declared, country-specific #rates, limited to a maximum of 70% of the corresponding #domestictariffs, with the increase spread over several years.

-An additional #regulation for “big” countries (primarily demanded by, and tailor-made for, the USA) allowed terminal dues to be raised to the level of the new #model immediately.

Although the new model was fairer ̶ at least from the standpoint of the major #importing countries ̶ unsurprisingly, it led to another significant #decrease in #volumes transacted through the UPU system. The increased UPU tariffs made the classic UPU model less #competitive. This was compounded by other factors, most notably the EU VAT Ecommerce Package, with European DOs charging high #customsclearance #fees for „Delivery Duty Unpaid“ (DDU).

𝗛𝘂𝗴𝗲 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝗶𝗻 𝗱𝗶𝗿𝗲𝗰𝘁 𝗲𝗻𝘁𝗿𝘆 𝗯𝗮𝘀𝗲𝗱 𝗼𝗻 𝗯𝗶𝗹𝗮𝘁𝗲𝗿𝗮𝗹 𝗰𝗼𝗻𝘁𝗿𝗮𝗰𝘁𝘀 𝗮𝗻𝗱 𝗰𝗼𝗺𝗺𝗲𝗿𝗰𝗶𝗮𝗹 𝘀𝗼𝗹𝘂𝘁𝗶𝗼𝗻𝘀

As a result, the DO’s individual tariff models became more important. Contrary to the basic UPU model, where a DO is primarily responsible for mailers in its #domesticmarket, volumes are acquired abroad (often through partners and subsidiaries), cleared through #customs, released for final delivery in all of the #EU, and then forwarded to #postaloperators in the #destinationcountry on the basis of #bilateral and #multilateral #agreements.

As UPU rates are based on standard #domesticrates while wholesale rates are usually much lower, these wholesale rates have generally become more attractive than UPU rates, especially in tracked #shipments.

Hier geht es zum LinkedIn-Artikel.

Walter Trezek

Document Exchange Network GmbH