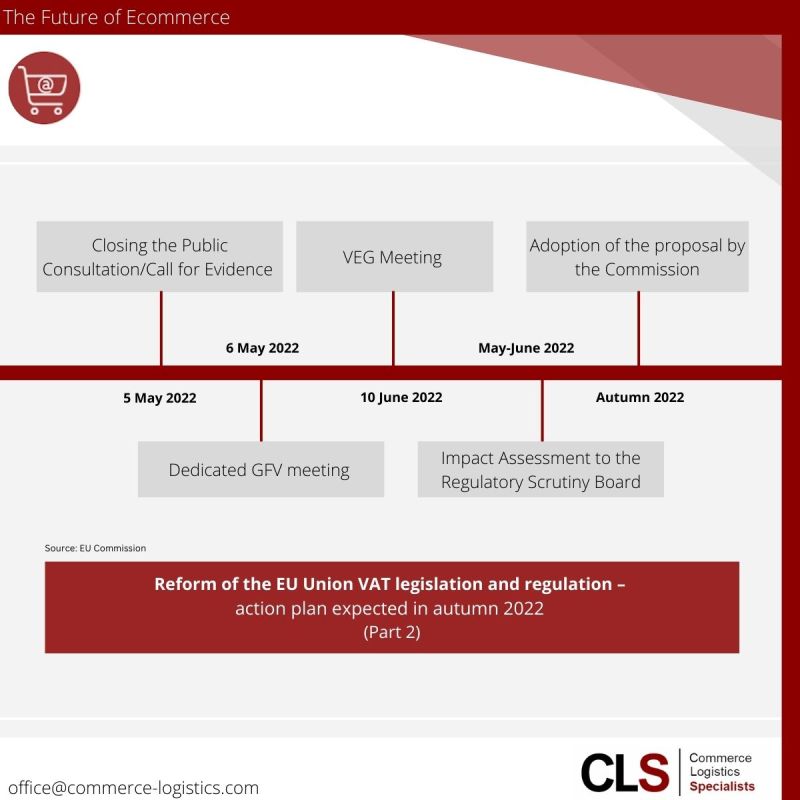

Reform of EU Union VAT legislation and regulation: Action plan expected in autumn 2022 (Part 2)

This series has examined three immediate areas for action which the #EU has identified and – given the cross-border nature of the #problems – require a common #European #solution.

The #EUCommission has announced a #legislative package, “VAT in the Digital Age”, which is currently under discussion and due to be finalized. The current #proposal includes the following #policy options:

𝗛𝗮𝗿𝗺𝗼𝗻𝗶𝘇𝗲𝗱 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝗿𝗲𝗽𝗼𝗿𝘁𝗶𝗻𝗴 𝗿𝗲𝗾𝘂𝗶𝗿𝗲𝗺𝗲𝗻𝘁𝘀, 𝗶𝗻𝗰𝗹𝘂𝗱𝗶𝗻𝗴 𝗲-𝗶𝗻𝘃𝗼𝗶𝗰𝗶𝗻𝗴

Partial (limited to cross-border transactions) or fully harmonized #digital reporting requirements, and the possibility of mandatory e-invoicing and standardized digital #storage obligations.

𝗦𝗶𝗻𝗴𝗹𝗲 𝗩𝗔𝗧 𝗿𝗲𝗴𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 𝗶𝗻 𝘁𝗵𝗲 𝗘𝗨: 𝗺𝗮𝗻𝗱𝗮𝘁𝗼𝗿𝘆 𝗜𝗢𝗦𝗦 𝗳𝗼𝗿 𝗶𝗺𝗽𝗼𝗿𝘁𝘀 𝗼𝗳 𝗕𝟮𝗖 𝘀𝘂𝗽𝗽𝗹𝗶𝗲𝘀

This would #result in unified #VAT registration covering:

– Domestic #B2C supplies of goods

– Intra-EU #transfers of #goods cross-border

– B2C distance #sales of imported goods which cross EU #customs borders

#IOSS could become #mandatory for all B2C #supplies imported into the EU, and the EUR 150 threshold abolished. The #scope is currently under #discussion (mandatory for all #traders, or for traders above a certain threshold).

𝗜𝗧 𝗶𝗻𝗳𝗿𝗮𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗻𝗲𝗲𝗱𝗲𝗱 𝘁𝗼 𝗿𝗲𝗱𝘂𝗰𝗲 “𝗳𝗿𝗮𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻 𝗰𝗼𝘀𝘁𝘀”

There will be #costs associated with introducing new digital reporting obligations, but reducing the “#fragmentation costs” caused by differences in #data #reporting #requirements between Member State #jurisdictions would #benefit all #businesses. This part of the initiative will require new #IT #investments and perhaps a longer #implementation period. However, Member States investing in their IT will immediately benefit from having a more #efficient tool to fight #fraud, and can make good use of the data to provide better #services to #taxpayers.

𝗦𝗶𝗺𝗽𝗹𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝗰𝗿𝗲𝗮𝘁𝗲𝘀 𝗮 𝗹𝗲𝘃𝗲𝗹 𝗽𝗹𝗮𝘆𝗶𝗻𝗴 𝗳𝗶𝗲𝗹𝗱

Having a single VAT registration in the EU should lead to lower compliance #costs and create a level playing field, especially in #economic #sectors such as the installation and assembly of goods, #logistics and #energy suppliers, where the need for multiple VAT numbers is common under the current system.

Mandatory IOSS for all #imports, irrespective of thresholds, should further simplify the cross-border exchange of B2C #supplies and make life easier for EU customs and #tax authorities – provided they actively exploit the potential offered by #digitalization.

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH