Explained simply by CLS: The Evolution of Postal Tariffs (part 6)

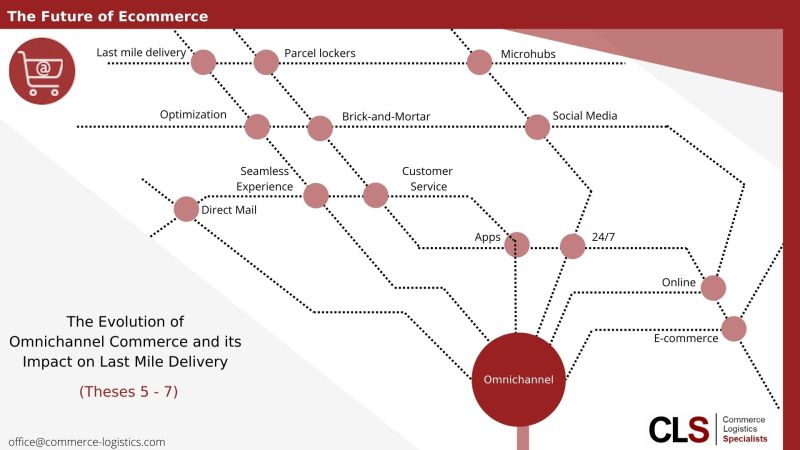

Continuing our examination of the evolution of omnichannel commerce and its impact on #lastmile delivery (Theses 5-7):

𝟱. 𝗜𝗻 𝘀𝗼𝗺𝗲 𝗶𝗻𝘀𝘁𝗮𝗻𝗰𝗲𝘀, 𝘀𝘁𝗮𝘁𝗶𝗼𝗻𝗮𝗿𝘆 𝗿𝗲𝘁𝗮𝗶𝗹 𝗶𝘀 𝗯𝗲𝘁𝘁𝗲𝗿 𝗽𝗿𝗲𝗽𝗮𝗿𝗲𝗱 𝗳𝗼𝗿 𝗻𝗲𝘄 𝗹𝗮𝘀𝘁-𝗺𝗶𝗹𝗲 𝗺𝗼𝗱𝗲𝗹𝘀 𝘁𝗵𝗮𝗻 𝗼𝗻𝗹𝗶𝗻𝗲 𝗿𝗲𝘁𝗮𝗶𝗹

For years, it was a given that the rapid growth of #marketplaces and online retailers was pushing brick-and-mortar #retailers on the defensive. #Online retail will indeed continue to grow, but the rise of #urban same-day #delivery models for groceries and fast-moving #supplies has suddenly given brick-and-mortar retail an #advantage, helping it secure a bigger #share of the #ecommerce market.

Having the necessary micro-hub #locations, i.e., retail #outlets, is an #asset that pure online retailers need to #invest capital and resources to replicate. In some cases, a lack of suitable physical #locations makes this impossible.

However, major brick-and-mortar retailers must acquire the relevant #digital competence and #service orientation needed to compete in ecommerce. Their other option is to connect their micro-hubs (distributed #inventorynetwork) to existing urban same-day delivery #infrastructures.

𝟲.𝗠𝗮𝗿𝗸𝗲𝘁𝗽𝗹𝗮𝗰𝗲𝘀 𝗮𝗿𝗲 𝗹𝗶𝗸𝗲𝗹𝘆 𝘁𝗼 𝗱𝗲𝘃𝗲𝗹𝗼𝗽 𝗶𝗻 𝗼𝗻𝗲 𝗼𝗳 𝘁𝘄𝗼 𝗱𝗶𝗿𝗲𝗰𝘁𝗶𝗼𝗻𝘀

Over the long term, it will become increasingly difficult to be simultaneously an online retailer and a #service provider/sales platform for third-party retailers. Consequently, #electronic interfaces will tend to choose between these two paths. We see one major #platform appearing to shift its #strategy, becoming both an own brand #manufacturer and retailer rather than a neutral #marketplace. The alternative is for marketplaces to become neutral service providers, not competing with the #merchants they host or unduly binding #users.

𝟳.𝗪𝗲 𝗲𝘅𝗽𝗲𝗰𝘁 𝗮 𝗺𝗮𝘀𝘀𝗶𝘃𝗲 𝗿𝗶𝘀𝗲 𝗶𝗻 𝗱𝗶𝗿𝗲𝗰𝘁 𝗲𝗻𝗴𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝗯𝘆 “𝘄𝗵𝗶𝘁𝗲 𝗹𝗮𝗯𝗲𝗹” 𝘀𝗲𝗿𝘃𝗶𝗰𝗲 𝗽𝗿𝗼𝘃𝗶𝗱𝗲𝗿𝘀 𝗮𝗻𝗱 𝗺𝗮𝗻𝘂𝗳𝗮𝗰𝘁𝘂𝗿𝗲𝗿𝘀 (𝗦𝗠𝗘𝘀)

Historically, #retail developed by bundling goods from different #manufacturers and taking over #sales and #distribution. Later, retailers became #competitors to manufacturers, by entering #production themselves and pushing their own #labels – both in brick-and-mortar #retail and ecommerce. We now expect manufacturers to push back by increasingly selling directly online, bypassing retailers, and using neutral #fulfilment #serviceproviders for #lastmiledelivery (standard delivery and urban same-day delivery via micro-hubs), and securing their #datasovereignty. The pressure on small retailers (online and offline) will remain. In 2021, manufacturers were already the fastest-growing ecommerce #segment in #Germany, ahead of marketplaces and traditional online retailers.

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH