Explained simply by CLS: The Evolution of Postal Tariffs (part 4)

There has been unprecedented #growth in #ecommerce and #commercial letter item #volumes over the past decade. Using a #tariffmodel based on #bilateral contracts and commercial #solutions which is considered fairer by the major importing countries, this has unsurprisingly led to another significant decrease in volumes transacted through the #UPU system with its less #competitive tariffs.

𝗧𝗵𝗲 𝗻𝗲𝘄 𝗘𝗨 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 & #𝗩𝗔𝗧 𝗺𝗼𝗱𝗲𝗹 𝗿𝗲𝘀𝘂𝗹𝘁𝘀 𝗶𝗻 𝗲𝘃𝗲𝗻 𝗵𝗶𝗴𝗵𝗲𝗿 𝗽𝗼𝘀𝘁𝗮𝗹 𝘁𝗮𝗿𝗶𝗳𝗳𝘀 𝗳𝗼𝗿 𝗺𝗼𝘀𝘁 𝗨𝗣𝗨 𝗶𝘁𝗲𝗺𝘀

On 1 July 2021, the #EU VAT eCommerce Package changed the EU’s VAT and #customs regime. All inbound #consignments (including #postalitems) are now subject to VAT, exemption limits have been abolished, and all items must be presented to customs #digitally in advance.

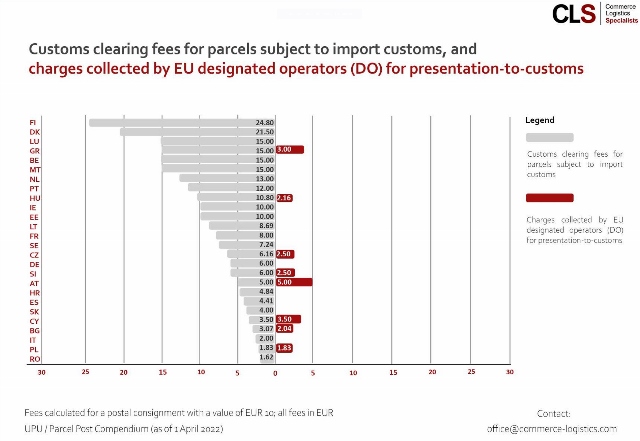

The UPU tariff model allows designated postal operators (#DO) in #destinationcountries to charge #fees (a) for the #customsclearance process (presentation to customs) and (b) for the collection of any duties. However, unlike the item/kilo rates which must reflect real costs, these additional charges can be set almost freely by the DO. While these fees were almost irrelevant prior to 1 July 2021, with almost all items in the #postalchannel having a #value of less than EUR 22 and therefore falling below the exemption thresholds, these fees now apply to all #items.

𝗡𝗲𝘄 𝗨𝗣𝗨 𝗰𝘂𝘀𝘁𝗼𝗺𝘀 𝗳𝗲𝗲𝘀 𝗮𝗿𝗲 𝗮 “𝗹𝗲𝘁𝗵𝗮𝗹 𝗯𝗹𝗼𝘄” 𝘁𝗼 𝘁𝗵𝗲 𝗨𝗣𝗨 𝗗𝗗𝗨 𝗺𝗼𝗱𝗲𝗹 𝗶𝗻 𝘁𝗵𝗲 𝗘𝗨

The fees for #collecting VAT on #Delivery Duty Unpaid (#DDU) items can be extremely high. Some EU DOs charge anything up to €25 per #transaction. Additionally, some DOs now also #charge high fees for the process of fully digital, simplified customs clearance – even where there are no #duties to #collect and #IOSS is used (see the chart below).

𝗖𝗼𝗻𝘀𝗲𝗾𝘂𝗲𝗻𝘁𝗹𝘆:

-volumes in the UPU #channel have fallen dramatically (by more than half), with postal DDU items becoming commercially unattractive;

-major #marketplaces (electronic interfaces) are using the IOSS model, clearing customs themselves and handing over the already cleared #shipments to the domestic DO outside the UPU channel;

-the B2B2C customs and shipping model has become increasingly relevant; and

-bilateral #postalcontracts or #agreements with #onlinemerchants and marketplaces offer a #cost advantage compared to UPU #tariffs.

(𝘵𝘰 𝘣𝘦 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦𝘥)

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH