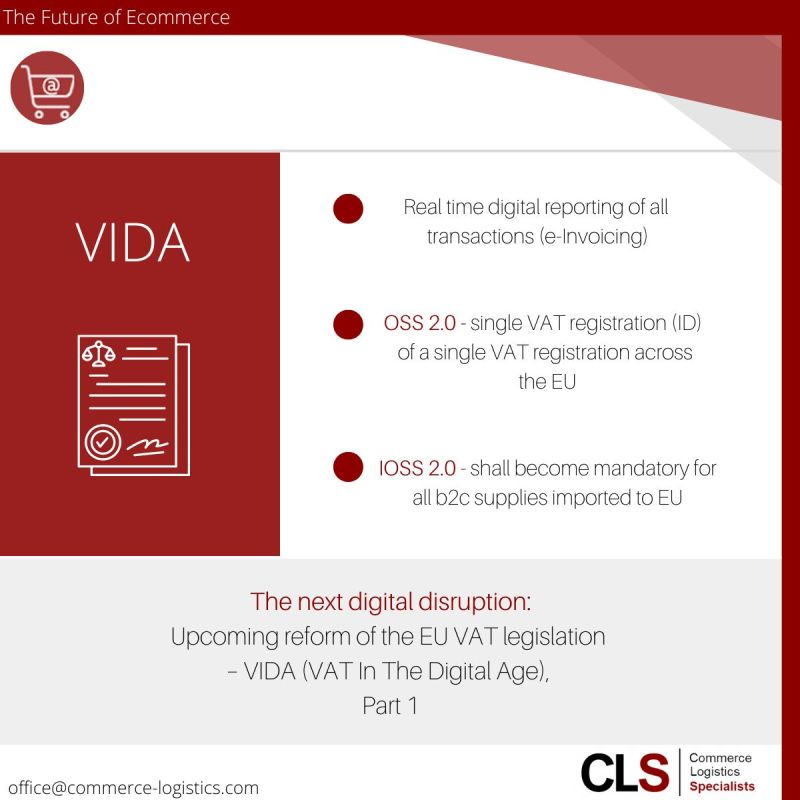

𝗧𝗵𝗲 𝗻𝗲𝘅𝘁 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝗱𝗶𝘀𝗿𝘂𝗽𝘁𝗶𝗼𝗻: 𝗨𝗽𝗰𝗼𝗺𝗶𝗻𝗴 𝗿𝗲𝗳𝗼𝗿𝗺 𝗼𝗳 𝘁𝗵𝗲 𝗘𝗨 𝗩𝗔𝗧 𝗹𝗲𝗴𝗶𝘀𝗹𝗮𝘁𝗶𝗼𝗻 – 𝗩𝗶𝗗𝗔 (𝗩𝗔𝗧 𝗶𝗻 𝘁𝗵𝗲 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝗮𝗴𝗲). 𝗣𝗮𝗿𝘁 𝟭

On 8 December 2022, the #EuropeanCommission adopted a #package to #optimise the EU’s Value Added Tax (#VAT) system. In the parts relevant to #ecommerce, #ViDA builds on the #EU VAT Ecommerce Package introduced in 2021. In the first part of this series we explain the #content of the #reform, before later exploring the background to and #impact of ViDA.

At a glance, ViDA contains three major #changes for ecommerce:

𝟭) 𝗥𝗲𝗮𝗹 𝘁𝗶𝗺𝗲 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝗿𝗲𝗽𝗼𝗿𝘁𝗶𝗻𝗴 𝗼𝗳 𝗮𝗹𝗹 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 (𝗲-𝗜𝗻𝘃𝗼𝗶𝗰𝗶𝗻𝗴)

It will become mandatory to report all cross-border #transactions in real-time for VAT purposes (including physical #B2C #supplies, within EU or imported to EU) by means of e-invoicing. All EU Member States will have #access to a consolidated EU reporting system, allowing them to immediately address VAT #fraud.

𝟮) 𝗢𝗦𝗦 𝟮.𝟬 – 𝘀𝗶𝗻𝗴𝗹𝗲 𝗩𝗔𝗧 𝗿𝗲𝗴𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 (𝗜𝗗) 𝗮𝗰𝗿𝗼𝘀𝘀 𝘁𝗵𝗲 𝗘𝗨

Building on the existing VAT One Stop Shop (#OSS) #model, a #company selling cross-border to other Member States will only need to #register for VAT once for the entire EU and is allowed to fulfil their VAT obligations via a single #online portal and in a single language. This removes many exemptions that currently hinder ecommerce (in particular, that local VAT registration is required in any EU state where a #warehouse is operated, regardless of OSS). OSS will be largely aligned with IOSS in terms of its model.

𝟯) 𝗜𝗢𝗦𝗦 𝟮.𝟬 – 𝗜𝗢𝗦𝗦 𝘄𝗶𝗹𝗹 𝗯𝗲𝗰𝗼𝗺𝗲 𝗺𝗮𝗻𝗱𝗮𝘁𝗼𝗿𝘆 𝗳𝗼𝗿 𝗮𝗹𝗹 𝗕𝟮𝗖 𝘀𝘂𝗽𝗽𝗹𝗶𝗲𝘀 𝗶𝗺𝗽𝗼𝗿𝘁𝗲𝗱 𝗶𝗻𝘁𝗼 𝘁𝗵𝗲 𝗘𝗨

IOSS will become mandatory for the import of all B2C #supplies into the EU which fall below the intrinsic #value per #consignment of EUR 150. #Alignment with the upcoming EU Customs #Package (to be presented early next year) is planned.

The EU Commission expects to generate at least EUR 11 billion per year in additional VAT #revenue (avoided VAT fraud) as a #result of ViDA, and billions of euros in #savings through #administrative simplification.

𝗙𝘂𝗿𝘁𝗵𝗲𝗿 𝗹𝗲𝗴𝗮𝗹 𝗽𝗿𝗼𝗰𝗲𝗱𝘂𝗿𝗲

As a Council Regulation, ViDA will be binding for all Member States. The EU Commission is currently working on the #assumption that a consensus can be reached. The #negotiations with the Member States, which will then lead to a #decision, will be conducted under the Swedish EU Presidency beginning January 2023.

Click here for the LinkedIn-Article.

Walter Trezek

Document Exchange Network GmbH